Massachusetts Higher Ed:

Underfunded Unaffordable and Unfair

APRIL 2022

Executive Summary

In 2020, the average state aid a student received covered a meager four percent of their tuition and fees – making this aid no longer a factor for most low-to-middle-income families. MASSGrant, the state’s primary need-based grant for students, used to cover 80 percent of a student’s tuition and fees at a state school. Now it covers just 10 percent for those most in need of financial assistance.

With limited financial aid support and annual increases in tuition and fees, low-to-moderate-income students are forced to choose between balancing a heavy work schedule with their courses or taking out student loans to cover their unmet financial need. The average low-to-middle-income student is shouldering $10,000 in unmet need each academic year.

This debt often proves to be too burdensome for many low-to-middle-income families, especially those in communities of color – further exacerbating barriers people of color already face in higher education and in the workforce. In communities of color, only 36 percent of people have a college degree – while those rates reach 50 percent in predominantly white communities.

What has long been considered a critical step toward social and economic mobility in this nation is being held out of reach for Latino and Black and African-American families in Massachusetts, with many being forced to abandon the hope of a college degree for themselves and their children. High debt-burdened low-and-middle-income students who are able to graduate are at a significant disadvantage upon graduation – with hefty loan payments draining their resources, further exacerbating existing economic and racial disparities.

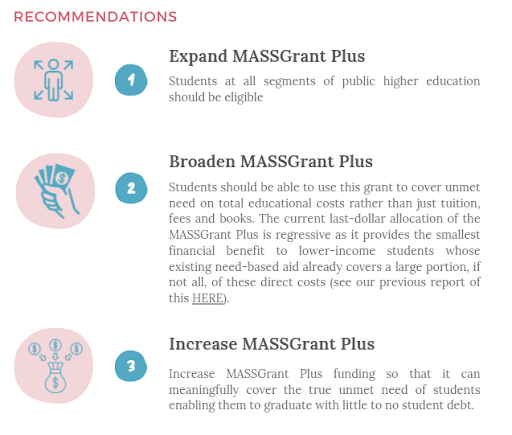

Recommendations

These findings point to unmet financial need as the main culprit for persistent achievement gaps.

Learn More

Key Findings:

More students at public colleges and universities take out loans than those at private, not-for-profit schools in Massachusetts

63% of students at public universities have to take out loans

53% of students at private, non-profit universities have to take out loans

Students attending state schools are graduating with more debt than their peers at private universities:

$24,112 – average student debt at graduation (at a four-year public university)

$23,940 – average student debt at graduation (at a four-year private university)

All of these burdens are leading to negative enrollment trends that further disenfranchised communities most in need of support and investment:

6.9% drop in undergraduate enrollment at all state public colleges and universities in 2020, followed by a 4.2% drop in 2021

Community colleges saw the sharpest rates of declining enrollment – especially among first-year Black and Latino students: seeing a 33% enrollment drop between 2019 and 2020

40% of the total revenue of our four-year public universities comes from tuition and fees because they are unable to rely on adequate state funding

Low-and-middle-income students facing unmet college costs are forced to work more than 10-15 hours/week, putting them more at risk of not graduating on-time or at all